Too often we struggle from paralysis analysis in selecting and executing our preferred strategy for property investing. And no wonder, with so many different strategies available from simply letting a spare room in our house to managing complex developments.

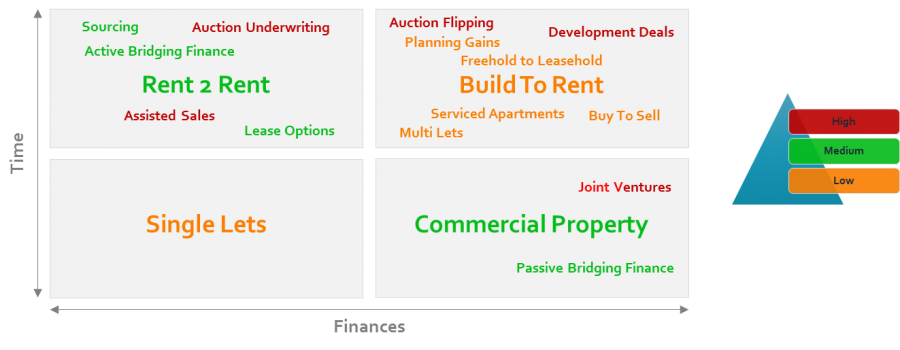

The reality is we spend too much time chasing shiny pennies rather than considering our current status quo. When working with property professionals, I always ask them to consider where they would position themselves on the quadrant below:

By understanding how much time you have available and your access to your own and external finances, then there are a limited number of strategies you should consider.

Evaluation of Strategies

For property professionals with little funds of their own but plenty of time, following a hands-on strategy such as Rent 2 Rent is likely to result in success to allow them to build up their capital base.

For professionals who have limited time maybe due to still working or running other businesses, single lets can provide strong returns over time with little requirements for hands on management, especially if the services of a good managing agent is utilised.

When professionals have access to significant funds and time, then executing the Build To Rent model that is sweeping across the UK currently, can provide significant returns when managed and executed well.

For those lucky enough to have significant funds but want to limit their time and leverage other resources, sourcing and acquiring prime real estate in cities with strong corporate clients is a great strategy to provide a robust income over the long term.

As your status quo changes, I believe you should consider following strategies as per the quadrants above. Interestingly, I find many property professionals want to operate in the top right quadrant, as strategies such as development and Build To Rent is considered to be at the top of the pyramid of property investing.

In contrast, I would much rather operate in the bottom right of the quadrant as it allows you to leverage other resources whilst protecting your own time.

Outcome of Strategies

When selecting a strategy it is important to consider what the financial outcome will be in terms of immediate cash flow and capital gain.

When we start off in investing, ultimately it is about obtaining enough cash flow to make the model sustainable long term. Following cash flow, our focus needs to be on profitability and then the overall strength of our balance sheet.

Cash flow is key but the real gain from property is in capital appreciation if you can stay in the market long term. Therefore, I think it is important that investors consider when they should move their focus towards assets that are likely to provide long term capital appreciation.

As you secure your cash flow and profitability, I would recommend investing funds in assets in prime locations with lower loan to values to protect against the likely lower investment yield. Whilst Liverpool student properties have provided me with a robust yield over the last couple of years and will also do so in the future, I am fully aware if I was to contrast their performance with London residential property over a twenty year period, there will only be one winner due to capital appreciation.

Risk of Strategies

Finally we must also consider our risk profile when selecting the appropriate strategy.

Whilst development deals can be financially lucrative, returns can be extremely volatile, by the nature that the property market is cyclical. Perception to risk will also vary depending if your focus is around operating as a business or purely as an investor.

Hope the above helps you in identifying the most appropriate strategy for you at the current time, always remembering over time our strategies should be revisited and repositioned based on what is right for us at that time.

If you would like to find out how I can work with you in helping you select and execute the best strategy for you, then please look at details of my 90 Day Program Coaching Program Leaflet and Board Room Coaching Monthly Board Meeting services that I currently work on, on a 1:1 basis with individual investors.